Financial Aid

- Home |

- Prospective Students | Financial Aid

About Us

Western State Social

Youtube

Podcast

Helpful Links

Getting Started

Need financial assistance? Applying for financial aid can be a daunting process. We’re here to help! Our Student Finance Office works hard to provide opportunities to those students for whom finances are a determining factor. Contact us with questions:

MAILING ADDRESS

Western State College of Law

Student Finance Office

15101 Red Hill Ave,, #100

Tustin, CA 92780

Phone: (714) 459-1120

Fax: (714) 525-6721

Email: financialaid@wsulaw.edu

OFFICE HOURS

- Monday: 9:00 a.m. – 6:30 p.m.

- Tuesday: 9:00 a.m. – 6:30 p.m.

- Wednesday: 9:00 a.m. – 6:30 p.m.

- Thursday: 9:00 a.m. – 6:30 p.m.

COST OF ATTENDANCE

The cost of attendance represents the maximum amount of financial assistance that you can receive from a combination of all sources, not to exceed program limits. To determine the cost of education, the Financial Aid Office establishes standard budgets that reflect average expenses. These budgets vary according to living arrangements and the length of the award period. Each budget includes average tuition and fees, books and supplies, housing, food, transportation, and personal expenses. These budgets serve as a guide for reasonable expenses for a “modest standard of living.”

Direct Expenses are those that a student will pay directly to the school, such as tuition and fees. Direct costs are subject to change. Any changes are posted on our website as soon as possible. Please contact the Admission Office at admissions@wsulaw.edu if you have any questions.

Indirect Expenses are an estimation of other educationally related expenses that a student may incur while in school. While they are not paid directly to the school, they should be planned for by each student. The information provided is an estimate of costs and may not reflect a student’s personal housing decision or other life choices. Your actual expenses will most likely be different.

| 2025-2026 Direct Expenses [Standard Academic Year (fall & spring)] |

Full-time Costs | Part-time Costs |

|---|---|---|

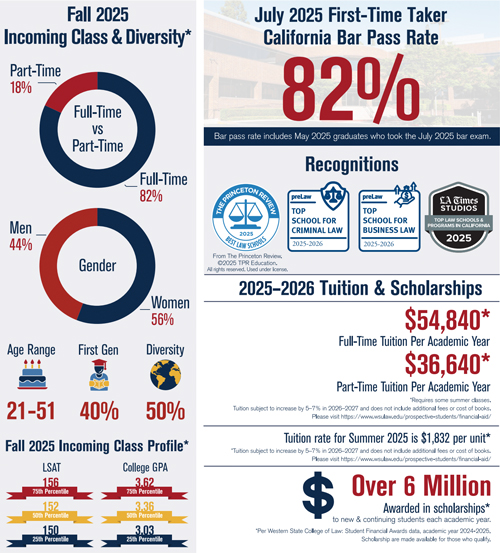

| Tuition | $54,840.00 | $36,640.00 |

| Registration Fee | $100.00 | $100.00 |

| Student Activities Fee | $160.00 | $160.00 |

| Academic Success Fee* | $548.00 | $411.00 |

| Total Direct Costs | $55,648.00 | $37,311.00 |

| Other Potential Direct Expenses | ||

| Overload Tuition ($1,832.00 per unit) | ||

| Estimated Summer Tuition (based on 4 units/WSCL average) for part-time students @ $1,832 per unit. (Part-time student may take up to 6 units and full-time students may take up to 7 units in the summer session.) | $7,328.00 | |

| Summer Registration Fee | $50.00 | |

| STRF** (new students only) | $0.00 | $0.00 |

| 2025-2026 ESTIMATED Indirect Expenses for a self-supporting student not living with a parent or relative for the 9 month academic year |

Estimated Costs for a Full-time Student | Estimated Cost for a Part-time Student |

|---|---|---|

| Books, Course Materials, and Supplies | $2,330.00 | $1,328.00 |

| Housing and Food (formerly called Room and Board) |

$22,752.00 | $22,752.00 |

| Transportation Expenses | $1,960.00 | $1,592.00 |

| Miscellaneous Personal Expenses | $5,068.00 | $5,068.00 |

| Total Estimated Living Expenses | $32,140.00 | $30,740.00 |

| Other Estimated Indirect Expenses | ||

| Federal Loan Fees*** | ||

| -Federal Direct Unsubsidized Student Loan | $210.00 | $210.00 |

| -Federal Direct Graduate PLUS (loan) | $1,692.00 | $1,455.00 |

| Credential Fees**** | $2,218.00 | $2,218.00 |

* An Academic Success Fee will be assessed each semester for students starting in fall 2023 and beyond.

** STRF is a fund administered by the State of California Bureau for Private Postsecondary Education. For more information go to https://bppe.ca.gov/lawsregs/strf.shtml

*** For students borrowing federal student loans for the 2025-2026 academic year, the average educational loan fees for borrowers will automatically be added to the cost of attendance.

**** The estimated cost of the California Bar Exam and MPRE will be added to the Cost of Attendance for students graduating during the award year.

LOAN PROGRAMS

Please contact Student Services for more information.

Student loans are borrowed money that must be repaid, with interest and loan fees. They are legal obligations, and it is important that you review the responsibilities of borrowing, know the terms, and understand what you will have to repay over the years. Borrowers must meet federal and institutional eligibility requirements.

William D. Ford Federal Direct Loan (Direct Loan) Program https://studentaid.gov/understand-aid/types/loans

Federal Direct Unsubsidized Loans https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

- The U.S. Department of Education is your lender

- Annual and aggregate Federal loan limits apply

- Not based on financial need

- School determines amount you can borrow based on cost of attendance (determined by the school) and other financial aid/scholarships

- loan fees apply

- Interest accrues and the borrower is responsible for paying the interest during all periods. Interest accrues from disbursement and any unpaid interest is capitalized (added to the principal amount of your loan).

- entrance counseling is required

- Master Promissory Note is required

- Exit interview is required

- The U.S. Department of Education is your lender.

- You must not have an adverse credit history. A credit check will be conducted. If you have an adverse credit history, you may still be able to receive a PLUS loan if you meet additional requirements.

- Not based on financial need

- School determines amount you can borrow based on cost of attendance (determined by the school) and other financial aid/scholarships

- loan fees apply

- Interest accrues and the borrower is responsible for paying the interest during all periods. Interest accrues from disbursement and any unpaid interest is capitalized (added to the principal amount of your loan).

- entrance counseling is required

- Master Promissory Note is required

- Additional counseling may be required

- Exit interview is required

SCHOLARSHIPS & PAYMENT PLANS

When you have been admitted, you are automatically considered for a scholarship. There is no supplemental application! You will be notified if you have been awarded a scholarship.

- Scholarships – Western State offers merit scholarships to eligible new and continuing students. Scholarships cover tuition only; books, fees, and living expenses are not covered. A student may not receive more than 100% of tuition for any one semester from scholarship or remission sources. All scholarship programs are subject to change at any time without notice.

- Tuition Payment Plans – Western State offers short-term payment plans to help students meet their financial obligations to the law school. With these approved plans, students are able to make tuition and fee payments throughout the semester and/or while awaiting the delivery of financial assistance funds. Contact the Student Accounts Office for more information.

FINANCIAL AID CHECKLIST

Please contact Student Services for more information.

Start your financial planning EARLY! Due to the high cost of private education, most students require financial assistance to pay for their studies. We encourage you to start the application process early in order to pursue all possible sources of financial assistance. Ready to get started? Follow these steps:

- Complete and submit a Free Application for Federal Student Aid (FAFSA). No matter which law school you choose, you’ll need to complete a FAFSA if you plan on receiving financial assistance. Go to https://studentaid.gov/h/apply-for-aid/fafsa. Use School Code 042496.

- Complete and submit an Application for Financial Assistance (AFA) to our Student Finance/Student Services Office. Once you’ve been admitted, we’ll send you an application packet, which will include our Financial Assistance Handbook and the AFA form mentioned above.

- Review your Student Aid Report and make any needed corrections and resolve any federal comments.

- Respond to requests for information from us.

Western State College of Law

15101 Red Hill Ave

Tustin, CA 92780

714-738-1000

See wsuprograms.info for program duration, tuition, fees and other costs, median debt, salary data, alumni success, and other important info.